The past few years have shown a steady maturing of the FFF 3D printing market, followed by increased awareness as a viable manufacturing method.

The 3D Printing and Additive Manufacturing State of the Industry Report, published by Wohlers Associates in 2018, predicts that the adoption of additive manufacturing in the workplace will continue to expand, with the sale of additive manufacturing products and services expected to reach $ 28 billion by 2023.

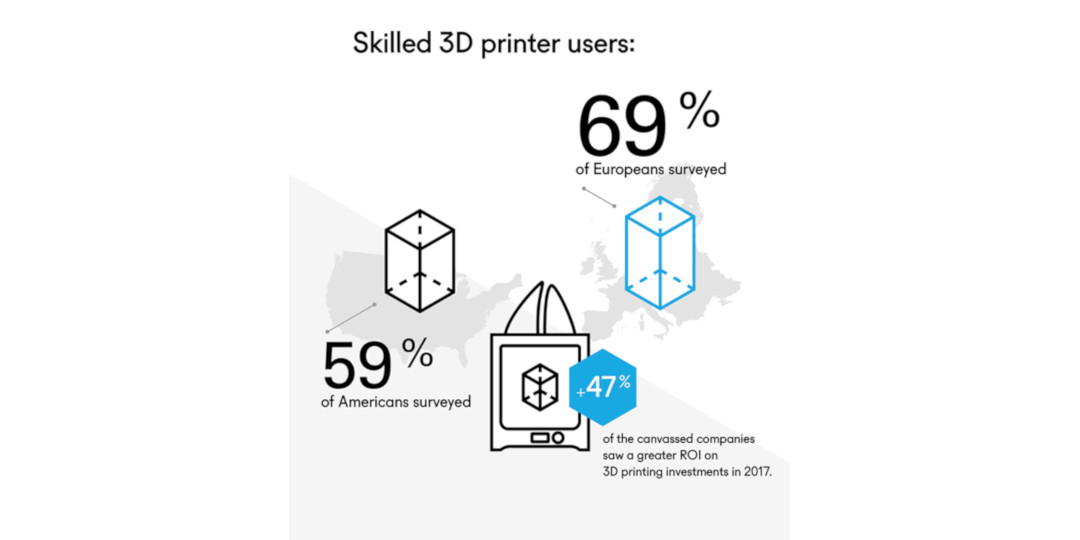

A 2017 Sculpteo study—focused on professionals utilizing additive manufacturing—found that 59 % of Americans and 69 % of Europeans surveyed are skilled 3D printer users. Additionally, 47 % of the canvassed companies saw a greater ROI on 3D printing investments in 2017 than in 2016.

A rapidly growing market sector

Wohlers Associates defines desktop 3D printers as additive manufacturing systems that sell for under $ 5000. It is this segment that has experienced an exponential rise in sales throughout the past decade, from estimated 66 systems sold in 2007, to an astounding 528,952 units in 2017. The same report medians the average selling price of the desktop system in 2017 at the $ 1,154 mark, making it on average approximately 81 times cheaper than the average price of an industrial 3D printing system ($ 94,252).

An emergence and steady rise of the ‘prosumer’ (professional consumer) segment of the desktop 3D printing market is particularly interesting to observe. Retailing on average above $ 3000 and often exceeding $ 5000, prosumer machines are aimed at enterprises in need of a reliable in-house rapid prototyping solution.

The 'false start' of FFF

Early 2012 witnessed the peak of what is now referred to as “The 3D printing hype” – a moment in time when 3D printing and its possible applications entered the news stream as “The new industrial revolution” and “Industry 4.0”. While this propelled keen public interest, it also had the undesirable side effect of creating unrealistic expectations regarding the technology and its potential. The clash of expectations of what could be versus what was feasible formed many decisions that FFF systems were insufficient tools.

Many professional consumers who attempted to incorporate early systems into their production workflow experienced a 'false start' effect, which formed a negative opinion on the capabilities of FFF systems, and prompted them to either invest in an entry-level high-end additive manufacturing system, outsource the production of parts to an external provider, or move away from FFF altogether in favor of traditional fabrication methods.

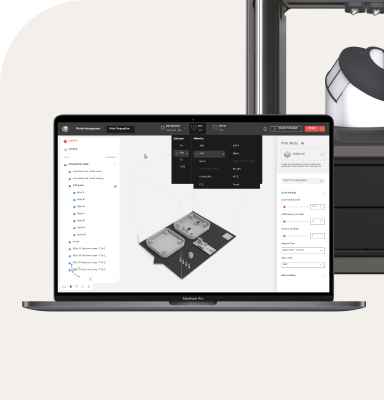

FFF systems that are currently available on the market have advanced a long way since their DIY origins. The main drawbacks of the early systems included low-quality results (parts which often featured prominent layering, underextrusion, or deformations), lack of print consistency (no guaranteed repeatability), limited material selection (at the time, the leading filament was either PLA or ABS), and limited build volume. Further problems were caused by unoptimized 3D files and slicing software, as well as unreliable hardware. Moreover, in order to perform their best, the machines required regular maintenance and a certain degree of technical know-how to operate correctly (hardware calibration and cleaning) and optimize the end results (slicer software calibration). Prosumer manufacturers have since resolved these issues: quickly evolving and agile, prosumer desktop systems are themselves the result of iterative design, with each iteration further optimizing the hardware, software, and materials, to create easy to use, functional, and ultimately reliable systems that can be adapted into any office.

Prosumer systems have the potential to change the way FFF systems can be perceived as a whole. With the emergence of prosumer desktop solutions, there are a few reasons why now might be a good time to rethink the previous limitations of the desktop-based systems, and open up to the possibilities the iterative design on the desktop-level.

The prosumer FFF market

84 % of companies surveyed for EY’s Global 3D Printing Report 2016 reported using 3D printing for product development, with 38 % expecting that additive manufacturing would become a part of their production processes to create end-use items by 2021.

With many 3D printing companies revisiting FFF in the context of upgrading solutions to a prosumer-level, prosumer systems will further bridge the gap between the desktop 3D printing and higher-end industrial additive manufacturing systems in terms of comparable surface finish and material versatility at fraction of the cost and time.

Despite their DIY roots, present-day FFF solutions have overcome the limitations of earlier machines, and now offer unprecedented reliability and versatility. The hardware, software, and materials have undergone significant development in order to offer a hassle-free user experience.

What makes the prosumer system a great addition to a workshop or an office is the fact that it makes the capabilities of high engineering possible in a safe, easy-to-use package that can bring significant savings and great ROI in a short period of time.